Last updated on: May 20, 2025

Nonprofit organizations are offering valuable services to the community in need but becoming 501(c)(3) certainly has many hurdles. Additionally, COVID-19 has impacted the timeline to be able to do this. IRS processing times can be confusing and lengthy, but we’re here to set expectations.

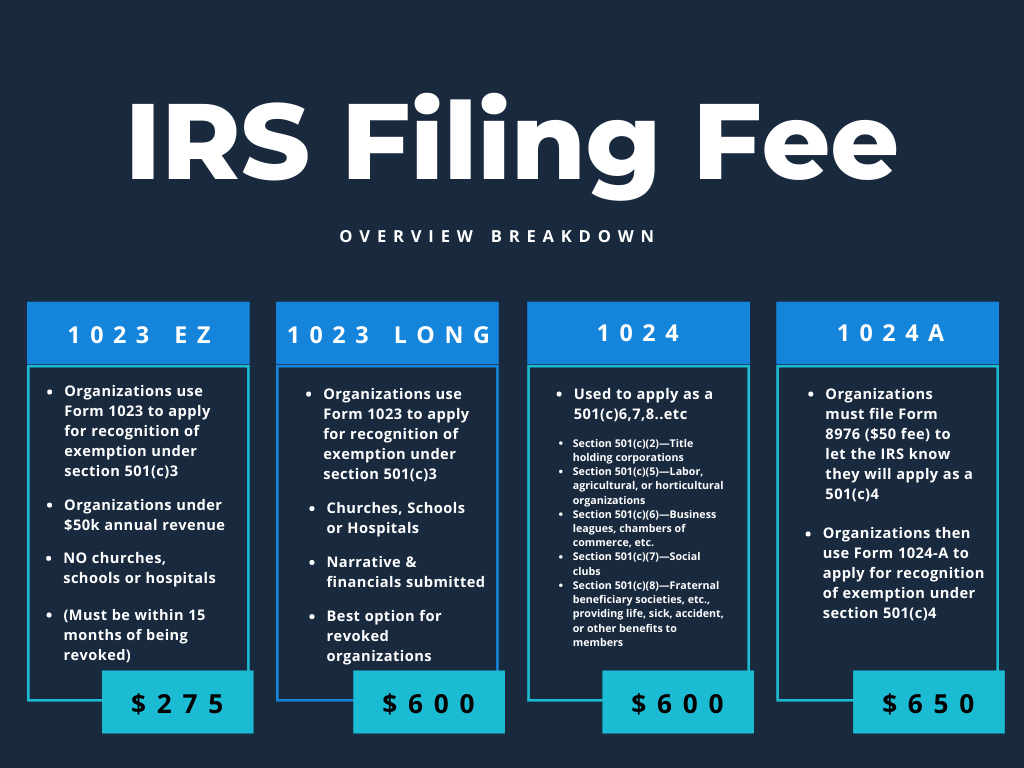

The IRS currently has two ways that you can apply for the 501(c)(3) Tax Exemption: The Standard 1023 form, or the 1023EZ online form. Each application comes with vastly different timelines.

Call Us at 1-877-857-9002

OR

Standard Form 1023 is a 40+ page application that includes a narrative description of program activities and a 3-year financial budget. Depending on the organization type, additional scheduling paperwork may be required. The fee to file Form 1023 with the IRS is $600 and there is no limit on funding raised. While this former paper application moved online in February 2020 (right before the pandemic started), the processing time for the IRS approval has significantly increased. Pre- COVID19, it would take up to 180 days or six months to be approved for the 501(c)(3) Tax-Exempt Status. Currently, the IRS is taking closer to nine to ten months in processing approval.

Check out this blog on the waiting period for the 1023 Application.

Form 1023-EZ does not nearly require the amount of information as the Standard Form 1023 does and it costs much less. You can file for tax-exempt status at a much lower cost of $275 using the online form. However, there is a cap regarding fundraising of 50k per year. The online form is three pages long and requires minimal written information; it mostly consists of checkboxes and the organization’s mission statement. Pre-COVID-19, the IRS was taking approximately 60 to 90 days to approve the 501(c)(3) Tax Exempt status. Now, the minimum processing time is 90+ days.

Read our blog on why the 1023 EZ might not be the best choice when applying for 501(c)(3) status.

Prior to submitting the 1023 application, you will need to ensure that your Articles of Incorporation or Charter have been filed at the state level and that the nonprofit has adopted Bylaws and a Conflict-of-Interest policy. BryteBridge is equipped to help you with all the required documents.

Moreover, the IRS is having trouble keeping up with the demand. Letters of 501(c)(3) determination are arriving to nonprofits but not being updated in the Tax Charity Search. This unfortunate delay can cause confusion for clients and potential funders. It is important to check your mail, scan, and keep the letter you received close. Letters have been sent to organizations, yet the IRS website is often months behind posting that the organization has received 501(c)(3) tax-exempt status.

Therefore, before deciding to start a nonprofit, talk to us about how we can help you meet the deadlines your organization needs. We can attempt to qualify you for expedited service or help you understand what you can do and cannot do while you await your 501(c)(3) determination letter. Together, we can decide on the type of exemption that best meets your needs.

Below are some important links and information directly from the IRS

Where’s My Application for Tax-Exempt Status?

To check to see if the IRS has started working on your 1023 tax-exempt application, click here!

Tax Exempt Organization Search Tool

Expect delays in data updates for the Tax-Exempt Organization Search tool. The IRS is still processing the 990 series received April 2020 and later.