If you’re wondering how to start a 501(c)(3) nonprofit organization, you’ve come to the right place. Since its inception, BryteBridge has helped nonprofit founders start over 45,000 501(C)(3) Nonprofit organizations. Additionally, we work with over 5,000 nonprofits yearly to keep them compliant and in good standing with the IRS.

You might have a fantastic idea and a willingness to help people, but operating a nonprofit organization requires time and resources. It’s essential to ensure you’re entirely ready before jumping in and starting a nonprofit business.

Having the right team and resources to start a 501(c)(3) is crucial to navigating the complex and time-consuming process of incorporating your organization and filings IRS Form 1023, which requires detailed information about the organization’s purpose, its planned activities, governance structure, and financial budget and projections. The IRS will carefully review the application to determine if the organization meets the requirements for tax-exempt status.

It’s important to note that not all organizations qualify for tax-exempt status and even those that may face ongoing compliance requirements to maintain their tax-exempt status.

Don’t let the complexity of the application process deter you from pursuing tax-exempt status for your organization.

Let the professionals at BryteBridge help you start your 501(c)(3) by navigating the process easily and confidently.

Preparation is Key

Determine if your 501(c)(3) fills a community need.

All 501(c)(3) nonprofit organizations require a clear and specific purpose. Sometimes called a mission statement, the IRS calls it the organization’s primary purpose. This purpose guides all activities for the lifespan of the organization.

When developing your primary purpose, it’s essential to think about the community you intend to aid. Are there other nonprofits that cater to that community and offer similar services? If so, that’s ok, but determine what will make your organization different. Find ways to add value where other organizations might fall short. Once you have a primary purpose, ensuring it is specific and focused is vital.

Identify a name for your 501(c)(3)

Finding the perfect name is not without challenges. First of all, the name must be legally permissible in your state. Naming rules vary by state but generally require including “Inc.” at the end. “Inc.” is short for “Incorporated” and defines the organization as a corporation.

Your organization’s name must also be unique in your state. While Help, Inc. might be the perfect name for your nonprofit organization, there is most likely already a Help, Inc. registered in your state. It’s crucial to research name availability before incorporating. A note of caution: some states will consider anything that sounds like a registered name off-limits. So even if a search nets no results, it does not guarantee the name is available. Name availability rules vary by state.

Additionally, many states and the IRS do not allow any form of punctuation in the name. Consider these rules when naming your nonprofit. For example, an organization might be called “Joe’s House, Inc.” but the IRS would require it to be documented as “Joes House Inc” instead. The lack of punctuation is not a big deal and does not affect the organization’s activities, but it is worth considering.

Tip: Search your state’s Secretary of State website to see if your preferred name is already registered.

Tip 2: If you plan on operating in multiple states or anticipate your organization growing significantly in size, make sure your name is available with the United States Patent and Trademark Office.

Recruit and Select an Initial Board of Directors

A Board of Directors provides oversight and guidance to the organization. These board members, trustees, or officers volunteer their time to provide direction, guidance and operate the nonprofit.

Every nonprofit organization requires at least three initial board members. They must fulfill the roles of President, Secretary, and Treasurer. These positions, known as officers, must be filled by different people in compliance with the IRS rules. While you might want to do all the work for your organization, it’s essential to find a team of people who share your vision and the workload.

While three people are the minimum, a Board of Directors can have as many members as it desires.

***Important Note:

The majority of board members (51% or more) cannot be related by blood or marriage. If an organization has a three-person board, no one related is permissible. There are different rules for Private Foundations.

Role of the Board of Directors

The board of directors plays a critical role in the success of a nonprofit organization. The board is responsible for setting the organization’s strategic direction and ensuring it has the necessary resources to achieve its goals. The board is also responsible for ensuring the organization operates within legal and ethical guidelines.

Secure Start-Up Funding

Forming a nonprofit can be a costly endeavor. State incorporation filing fees vary. States also have other required filings with a wide range of filing fees. On average, we see these fees run between $50 and $300. The IRS charges between $275 and $650 in filing fees depending on the type of tax-exempt organization you create. Programming expenses, websites, and operational costs

should also factor in the initial costs. You may also consider seeking the aid of an attorney, CPA, or nonprofit consultant, like BryteBridge, which adds to the initial expenses but will remove many of the headaches involved in the process.

Considering the initial costs and developing a fundraising plan almost entirely made up of private donations to cover planned expenditures is essential.

Will you be a Public Charity or a Private Foundation?

There are many different categories of nonprofit organizations. Generally, though, the IRS classifies them into two major buckets: public charity and private foundation. The difference between the two depends on whom the organization supports and how it receives funding.

Public Charity – In most cases, all other nonprofits are public charities. Public charities are formed for public benefit, meaning their services and programming are available to the entire community.

While public charities can focus on a specific charitable class, for example, elder care, their services are open to anyone in that class.

As a public charity, the organization receives funding in several different ways. These include private donations, corporate sponsorships, grants, and gifts from private foundations. We’ll cover all the options a public charity has for funding later in this guide.

Churches are a form of public charity. While their donations might come primarily from members’ tithes, those are considered personal and public contributions. All other rules governing public charities, including unrelated board members, apply to churches.

Private foundations operate to support individuals and other 501c3 nonprofit organizations through grants and scholarships. Private foundations receive most of their annual revenue (greater than 67%) from a single source. A great example is the Bill & Melinda Gates Foundation.

If you need help determining which option you should choose when starting a 501(C)(3) Nonprofits, please call BryteBridge, and we will help guide you to the solution that makes sense for your nonprofit organization.

Ready to start a 501(c)(3) Nonprofit Organization?

Are you and your team ready to start a 501(c)(3) Nonprofit? If so, here is the step-by-step guide on “How to Start a 501(c)(3) Nonprofit.”

BryteBridge is prepared to partner with you. We’ll provide a dedicated specialist to walk you through the following steps, ensuring your organization is ready to succeed! Here are the steps if you’d like to do on your own.

How to Start a 501(c)(3) Nonprofit Organization

How to Start a 501(c)(3) Step 1: Create Initial Documents

Once a nonprofit organization identifies a clear purpose, decides on a legal name, and establishes a Board of Directors, it is ready to start officially forming. While these three steps are crucial, more is needed to operate a nonprofit business legally. In nearly every state, asking for donations before starting a nonprofit can result in fines, penalties, and taxes.

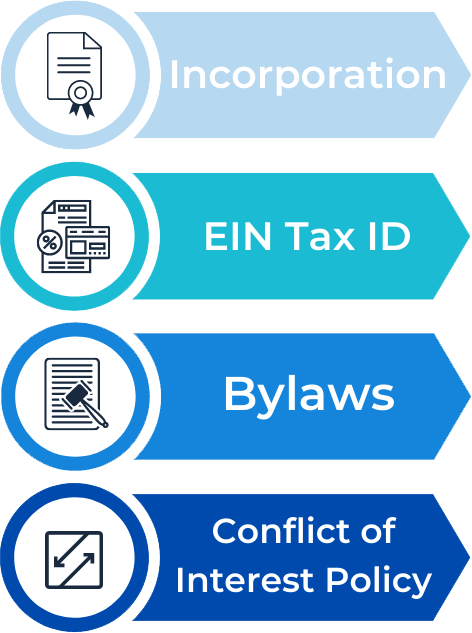

Step 1 in every nonprofit organization’s startup journey is what we at BryteBridge call the initial documents. These documents help set the organization up for legal operation in the state and prepare the nonprofit to file for federal tax-exempt status (which we discuss in the next step).

While starting and operating a nonprofit organization is different in every state, the initial documents are uniform. They are:

- Incorporation: Establish a legal corporation in the state of operation.

- Employer Identification Number (EIN): Create a federal identification number.

- Bylaws: Develop a set of governing practices.

- Conflict of Interest Policy: Develop rules to prevent potential profitability conflicts.

The initial documents create a corporation capable of legally operating in the state. These documents provide the necessary documentation to open a bank account, rent an office, and begin operations. Not to mention, anything donated to an organization before it legally forms is not tax-deductible.

How to Start a 501(c)(3) Step 2: Apply for Tax-Exempt Status

Establishing a nonprofit corporation is only the first of many steps required to create and operate a legal nonprofit organization. The next step is filing for federal tax-exempt status.

Tax-exempt status is the most essential step in the formation of a nonprofit. The IRS alone determines a nonprofit organization’s exempt status. Once recognized as tax-exempt by the IRS, the organization is not required to pay federal and (in many cases) state corporate income taxes. Without obtaining tax-exempt status, an organization is responsible for corporate taxes at both the federal and state level, even if incorporated as a nonprofit corporation.

Depending on the type of tax-exempt status issued by the IRS, donors may also claim donations to the organization as tax-deductible gifts on their taxes. Tax-deductible contributions are a big part of fundraising, which we’ll discuss later in the guide.

There are many types of tax-exempt status. A 501(c)(3) organization is the most common form. Most nonprofits fall into this Classification, though other tax-exempt types exist depending on the organization’s purpose. Different types include 501(c)(4) for politically focused organizations, 501(c)(6) for business leagues, and 501(c)(10) for fraternal orders. These are just a small selection of the 14 types of tax-exempt

organizations. Understanding what type of tax-exempt status to file for is crucial in forming your nonprofit.

Once the correct tax-exempt type is identified, applying for IRS tax-exempt status is time-consuming and detail-oriented. There are multiple applications: Form 1023 EZ, Form 1023, or Form 1024. These applications are upwards of 40 pages in length and often require many attachments and other IRS forms providing additional explanations and information.

The average person will spend between eight and ten hours filling out the IRS tax-exempt application. BryteBridge specialists are well-versed in every question asked on IRS applications. We will take your vision and correctly fill out the application on your behalf.

After an organization applies, it typically takes the IRS between three and six months to issue a determination. While the organization is waiting for status, it is free to operate as a nonprofit. However, there may be restrictions on soliciting donations, which we’ll cover in Step 3.

When the IRS issues tax-exempt status, it sends a Letter of Determination through the USPS to the organization’s address. This simple letter is a nonprofit organization’s most important document. It contains all information necessary to prove and maintain tax-exempt status. Organizations should keep this letter safe, though copies are often available on the IRS website a few months after the physical letter arrives.

How to Start a 501(c)(3) Step 3: File State Documents

After creating the initial documents and filing for federal tax-exempt status, it often feels like the startup work is complete. However, there are still several steps to go.

In most states, more than applying for federal tax-exempt status alone is needed to start asking for donations. Nonprofit organizations must file additional state documents with various agencies to complete their registration.

Unlike the initial documents, which, despite naming differences, are uniformly required across the country, state document requirements vary wildly. The difference between smooth operation and hefty penalties and late fees is knowing which documents your state requires.

While the process varies by state, the most common state documents are:

- Charity Registration: Required to ask the public for donations legally.

- State Tax Exemption: Required for exemption from corporate income taxes.

- State Sales Tax Exemption: Required for exemption from paying sales tax on purchases.

When and if an organization must file these documents depends on the state of operation. Some states allow filing on the same day as applying for IRS tax-exempt status. In contrast, others require receiving tax-exempt determination before filing. Since asking for donations often requires filing a charity registration, understanding your state’s document, and filing requirements is necessary for the startup journey.

Organizations may also need to register with their local county or municipal government. This registration, sometimes called a Business Permit or Occupation License, pays any necessary local taxes and grants the organization permission to operate legally. BryteBridge specialists can assist clients in ensuring their organization is operating legally.